Official statistics released today by the Society of the Irish Motor Industry (SIMI) show that the total new car registrations for the month of May were up slightly by 1.47% (6,080) when compared to May 2017 (5,992). Registrations year to date remain 4.32% (85,933) down on the same period last year (89,815). New Light Commercial Vehicle registrations (LCV) were up 12.5% (1,644) on May 2017 (1,461) and year to date are up 5.9% (15,943). While New Heavy Commercial Vehicles (HGV) have declined 4.2% for the month of May (228) compared to the same month last year (238) and are down 7.7% (1,385) year to date. Imported Used Cars have shown an increase of 18.35% for the month of May 2018 (8,979) when compared to May 2017 (7,587) while year to date they are 13% (43,738) ahead of 2017 (38,698)

Commenting on the figures SIMI Director General, Alan Nolan stated “The volume of Used imports is clearly the dominant feature and is continuing to impact negatively on the new car market. The slight increase in New car registrations for the month of May is not an indication of improvement, rather a case of altered timing in hire drive registrations with 470 more registered in May this year while the overall total for the year to date is actually 13 cars behind 2017. In line with earlier predictions Electric Vehicle (EV) sales have increased from 370 in 2017 to 512 this year. The number of Imported Used Electric Vehicles also increased from 165 to 280 this year. We would expect to see registrations of new EVs increase further as more new models come to market. The market share based on fuel type for the year to Date up to the end of May was: Diesel 55.6%, Petrol 37.9%, Hybrid 5.4%, Plug-in Hybrid 0.5%, Electric Vehicle 0.6%.

As we move into June the Industry is now focused on preparations for the start of the second peak sales period on 1st of July. In such a competitive market new car offers across all of the brands are very strong at the moment and the various advertising campaigns are in full swing. The advice to consumers, as always, is to shop around to find that deal that best suits their own specific needs.”

Stats in short:

• New car sales year to date (2018) 85,933 v (2017) 89,815 -4.32%

• New car sales total May (2018) 6,080 v (2017) 5,992 +1.47%

• Light Commercial Vehicles sales year to date (2018) 15,943 v (2017) 15,051 +5.9%

• Light Commercial Vehicles sales total May (2018) 1,644 v (2017) 1,461 +12.5%

• Heavy Goods Vehicle total sales year to date (2018) 1,385 v (2017) 1,501 -7.7%

• Heavy Goods Vehicle sales total May (2018) 228 v (2017) 238 -4.2%

• Used Car Imports year to date (2018) 43,738 v (2017) 38,698 +13.02%

• Used Car Imports total May (2018) 8,979 v (2017) 7,587 +18.35%

• Electric Vehicles total 2018 (512 ) v (370) +38.38%

• Electric Vehicles total May (88 ) v (30) +193%

• Car Hire total year to date (13,372 ) v (13,359) +0.1%

• Car Hire total May (1,868 ) v (1,398) +33.62%

• 5 Top Selling Car Brands Year to Date were:

1. Volkswagen 2. Toyota 3. Hyundai 4. Ford 5.Nissan

• 5 Top car model’s year to date were:

1.Nissan Qashqai 2.Hyundai Tucson 3.Volkswagen Golf 4.Ford Focus 5.Skoda Octavia

• Top Selling Car May: Toyota C-HR

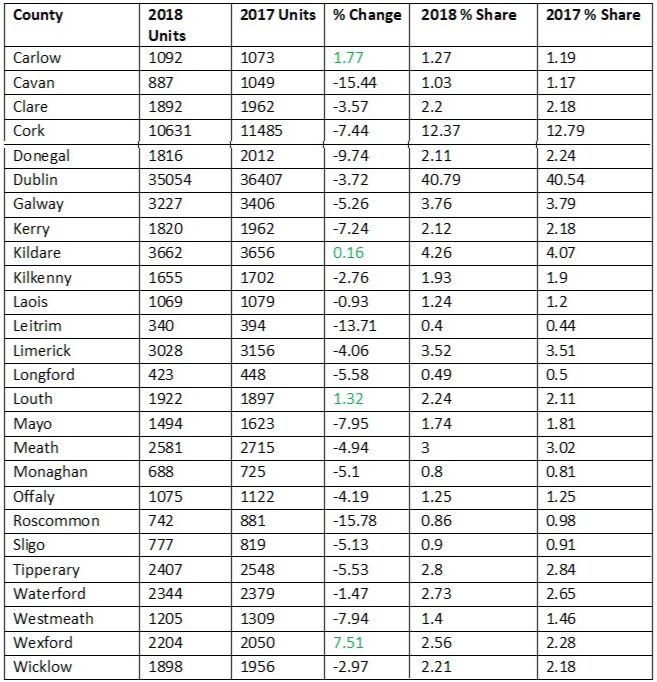

• Table below shows new car registrations by county year to date (January-May 2018)