Vehicle data expert Cartell.ie report this week that the proportion of vehicles offered for sale (across all years) with finance outstanding is 11.5% – up from 9.5% in June 2016. Cartell.ie also reports that more vehicles for certain key registration years are being offered for sale with finance outstanding than in 2015. From a sample of over 5,906 vehicles offered for sale and checked via the Cartell.ie website in 2016, the figures show that almost one-in-three registered in the last three years are offered for sale with finance outstanding.

In the case of one-year-old vehicles (2015) the levels of vehicles offered for sale with finance outstanding has risen from 26.7% for the equivalent period in 2015 to 31.5% in 2016 – representing an increase of 18%. This means there is now almost a one-in-three chance of a one-year-old vehicle bring offered for sale with finance outstanding. Similarly in the case of two-year-old vehicles (2014) there is a 28% chance of a vehicle being offered for sale with finance outstanding. Statistics published by Cartell.ie indicate that buyers have almost a one-in-three chance (27%) of purchasing a three-year-old vehicle (2013) with finance outstanding. Even older vehicles are regularly offered for sale with finance outstanding – 8.1% of all 2010 registered vehicles offered for sale had outstanding finance against them.

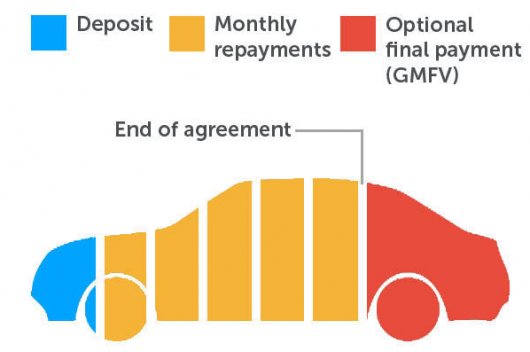

John Byrne, Cartell.ie, says: “Finance levels for cars offered for sale which are less than 3 years old are over 30%. This means a buyer in the market for a relatively new car needs to be particularly careful. The rising levels of finance for newer cars may be attributable to the prominence of PCPs – but remember the impact for a potential buyer is the same: the finance house owns the vehicle until the last payment is made. You can lose the car if you purchase it with finance outstanding. Overall finance levels are rising again. Cartell warned the market in 2015 that finance levels had bottomed out – and would rise. We anticipate levels reaching or even surpassing 13% in 2017.”